- All Posts

- Inflation Reduction Act: Domestic Content Under the Investment Tax Credit

Inflation Reduction Act: Domestic Content Under the Investment Tax Credit

Diving into the details of the legislation to help you understand your options.

The Inflation Reduction Act creates significant opportunities for building owners to ready their operations for long-term resiliency and eliminate deferred maintenance, realize cost savings, accelerate decarbonization and reach equitable outcomes for generations to come.

McKinstry Federal Funding Strategist Isabella Verdugo explains domestic content under the Investment Tax Credit (ITC):

Many programs in the ITC will allow for a larger incentive if domestic content is utilized. This bonus credit provides an incentive to source equipment, materials and systems domestically within the United States. Domestic content applies to steel and iron structural components. Examples from the IRS include steel racking, foundational rebar, and utility scale ground screws.

This is a 10% optional bonus credit if the project is under 1 megawatt. For projects that are larger, domestic content requirements must be met. For these projects, if labor requirements are met, the bonus credit will be 10%. If labor requirements are not met this will be a 2% bonus.

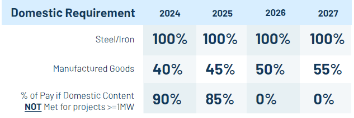

Tax exempt, direct pay entities must meet domestic content requirements starting in 2024 if the project is over 1 megawatt. These requirements increase over time based on the year that the project is placed in service. For projects over 1 megawatt, the percentage of direct pay benefit is reduced over time if domestic content requirements are not met (Image 1).

The second part of the requirements depends on the cost of the manufactured goods. The cost percentages is a sliding scale (Image 1). In 2024, 40% of the manufactured goods cost must be sourced in the US. This percentage increases by 5% each year, until 2027 where 55% of manufactured goods cost must be sourced domestically.

McKinstry is ready to be your partner and support you in meeting domestic content requirements.

For more information and resources, please visit our IRA blog or contact us below.

Interested in Learning More?

Please complete the required fields below to learn more about how McKinstry can help your organization achieve its sustainability goals.

Financial Disclaimer: McKinstry is not engaged in providing legal, tax or financial advice. The information provided herein is intended only to assist you in your decision-making and is broad in scope. Accordingly, before making any final decisions you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your specific circumstances.

Explore Other Insights

What Building Performance Standards May Mean for Your Bus…

How the needs of special use case buildings helped add nuance to legislation designed to impact positive climate chan…

New Center To Nurture the Health and Heritage of Indigeno…

The Mīyō Pimātisiwinkamik (“Good Life Lodge”) Youth Center project is a collaborative effort between the Rocky Boy’s …

Swinerton Joins South Landing Energy Ecosystem with Innov…

Overcast Innovations, Armstrong World Industries, Emerald Initiative and McKinstry to partner with Swinerton on deplo…